Peak Season Preview

With the 2018 4th Quarter underway, and peak shipping season close enough to touch, news outlets across the board are advising that the crunch of 2018 is not yet over despite recent dips in capacity demand. Factors such as fuel surcharge and driver pay increases are anticipated to keep rates at a new, elevated “norm”.

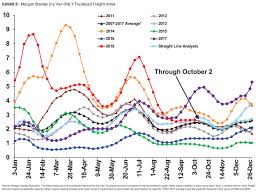

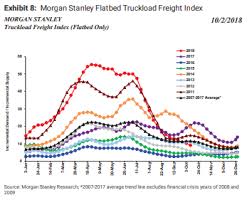

Morgan Stanley:

The latest Morgan Stanley freight index shows that the market has seen decreases in all modes (van, flatbed and reefer) for the 6th straight week in a row. Spot rates continue to stay elevated, remaining roughly 20% higher year over year according to DAT Solutions. Rates, particularly spot rates, are anticipated to increase roughly 4% through peak season and into 2019, per the Morgan Stanley Truckload Sentiment Survey.

Early into the Q4 peak season and executives from companies such as Shevell Group (who operates LTL carrier NEMF) are already reporting record freight turn downs.

4th quarter rate increases are expected, and will be due in part to the economy and e-commerce. Rates are expected to moderate in 2019, but pros emphasize a new baseline for rates is in place.