June 2019

Border Crossing Concerns

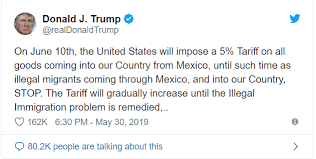

Economic and trade concerns were raised when in a recent Twitter post US President Donald Trump threatened a new wave of tariffs on Mexican goods.

In 2018, US trade with Mexico resulted in $671 billion, over 1/4 of the total trade done with/by the US in 2018.

Increased tariffs could stand to cause delays at the border as well as raise costs of goods.

Mind the Gap

The US Goods/Trade Gap has widened for a second month in a row, marking the highest deficit so far in 2019.

The 4.2% monthly decline in exports reflected broad-based drops across industrial supplies, capital goods, vehicles and consumer goods. A 2.7% decrease in imports was led by capital goods, vehicles and industrial supplies.

New Opportunities for Military Members

The FMCSA is launched a pilot program on June 3rd allowing a select number of individuals aged 18-20 to operate trucks in interstate commerce.

The program is designed to help military personnel with a CDL equivalent explore employment opportunities, while positively impacting the driver shortage.

February 2019

Economic Expectations

Economic activity affecting trucking could see a challenging year. With concerns around investment, import and export sectors as tariff and trade talks continue, there is much to keep an eye on already in Q1 2019.

Tech Talk

Uber, long known for their taxi-service like app is venturing into the full truckload industry. That’s not all, Uber Freight drivers are being asked to rate shippers.

Follow the Drivers

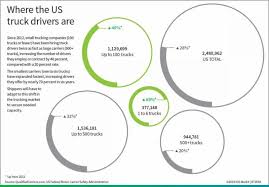

Small fleets of one to six trucks have expanded rapidly, data showing nearly 70% growth in six years where larger fleets have been struggling.

Bitter Blasts

The CRST International headquarters sit amongst frost covered trees along the Cedar River in Cedar Rapids, IA; where wind chills registered at -56 farenheit on 1/30/2019.

Winter weather shipping is challening during the mildest of winters. For tips, tricks and reminders make sure to check out our infographic below!

January Transportation Industry Updates

Driver Pay Hike in 2019

2018 was a lucrative year for truck drivers across the nation. However, the nationwide driver shortage, estimated at 50k, still looms. Last year saw unprecedented pay hikes for drivers simply to keep seats filled, yet still fleets everywhere saw their driver pools dwindle. Pressure to continue the pay hikes in response, is mounting.

Warehouse Woes

With an increase in production and spending across the USA, it’s no surprise that warehouses across the country are experiencing record low vacancies and rent price increases.

Teamsters Argue CA Break Laws

With each side, Teamsters and Federal Regulators, siting highway safety as their reasoning, laws surrounding California’s rest breaks for truck drivers may yet again be under review.

CRST introduces new President of CRST Logistics

To our valued customers:

It’s an honor to lead CRST International as the new President and CEO. I am thrilled with this new role

and I’m excited about many of the opportunities our teams will be working on together…. today and

in the future.

October Transportation Industry Update

Peak Season Preview

With the 2018 4th Quarter underway, and peak shipping season close enough to touch, news outlets across the board are advising that the crunch of 2018 is not yet over despite recent dips in capacity demand. Factors such as fuel surcharge and driver pay increases are anticipated to keep rates at a new, elevated “norm”.

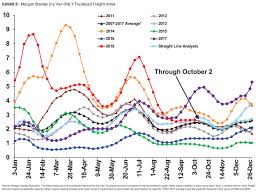

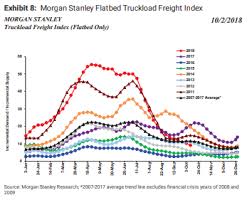

Morgan Stanley:

The latest Morgan Stanley freight index shows that the market has seen decreases in all modes (van, flatbed and reefer) for the 6th straight week in a row. Spot rates continue to stay elevated, remaining roughly 20% higher year over year according to DAT Solutions. Rates, particularly spot rates, are anticipated to increase roughly 4% through peak season and into 2019, per the Morgan Stanley Truckload Sentiment Survey.

Early into the Q4 peak season and executives from companies such as Shevell Group (who operates LTL carrier NEMF) are already reporting record freight turn downs.

4th quarter rate increases are expected, and will be due in part to the economy and e-commerce. Rates are expected to moderate in 2019, but pros emphasize a new baseline for rates is in place.

September Transportation Industry Update

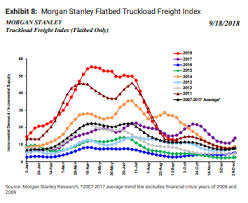

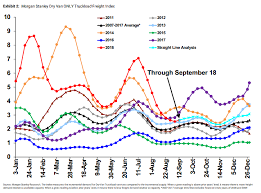

Morgan Stanley:

The latest Morgan Stanley reports (9/20/2018) notes that while the indeces have continued to drop and under preform general seasonality, as we move closer to peak shipping seaon anticipate stronger demand for trucks to drive the traditional end of year price hikes.

Florence Aftermath: Category 4 hurricane, Florence, left record breaking rainfall in her wake. Leaving large stretches of interstates unnavigable thus causing closures and thousands without power. If you are shipping to or from affected areas, please be sure to contact your CRST rep or local terminals for current information on weather related closures and delays.

Florence Aftermath: Category 4 hurricane, Florence, left record breaking rainfall in her wake. Leaving large stretches of interstates unnavigable thus causing closures and thousands without power. If you are shipping to or from affected areas, please be sure to contact your CRST rep or local terminals for current information on weather related closures and delays.

The JOC warns that while truck rate growth is expected to slow in 2019, it is still expected to rise and shippers should not anticipate a full return to balanced conditions.

With the driver shortage situation anticipated to jump from 20k short to 100k short within a decade, the idea of driverless semi-trucks is not only tempting but may just becoming reality.

August Transportation Industry Update

Morgan Stanley:

In Morgan Stanley’s latest report, dated 7/25/18, they show a downward trend in the truckloads indices stating that the 2 week “slightly underperformed seasonality”. Pointing to some relief after the abnormally tight market post-Roadcheck. However, 2018 is still expected to trend at all time highs.

Rising trucking costs bit into the bottom line of manufacturers, forcing them to sound the alarm to Wall Street.

Federal Reserve reports that tariffs and a shortage of truckers, and other skilled workers, could be acting as economic holdbacks.

Shippers, particularly in the retail industry, are shifting shipping modes more rapidly than expected, thanks to “Amazon Era”

Mid-July Transportation Industry Update

LTL Guaranteed Services

With truckload market rates at record setting levels, more and more shippers have been turning to LTL networks to get freight out of their doors. This flood of freight into LTL networks has caused delays in service, and for some carriers given cause to not honor reimbursement of a guaranteed service failure.

YRC Time Critical Service Alert

Morgan Stanley:

Some relief was finally felt in the truckload markets in the past two weeks. However, shippers should not take this as a sign that they are in the clear. The remainder of 2018 and early 2019 are still anticipated, across all forecasts, to set records and out-perform seasonality.

The LTL market is still solid, however shippers should watch for possible freight turn downs. The market is being flooded with the largest shipment sizes seen seince 2014.

ELD’s have now been enforced for several months, but the CVSA is focusing on safety factors outside of HOS as well. In a surprise brake inspection blitz, 1600 trucks were placed out of service.

Truckload demand continues to cause huge ripple effects across all modes of surface transportation. Shippers are advise to move goods early ahead of peak season capacity surges.

CSCMP’S Annual State of Logistics Report

Download and Read Here:

Upcoming Transportation Events

Good afternoon,

With the upcoming events anticipated to have an effect on the already tight transportation market, CRST Logistics wanted to make sure you are in the know. Below please find information regarding what to expect during the Memoriald Day weekend and the DOT Roadcheck.

| Memorial Day

With the upcoming Memorial Day holiday weekend, capacity is expected to tighten and transit delays may also be anticipated for freight moving over the weekend.

Increased tightness in the market is expected to begin Wednesday 5/23/18 and last through Tuesday 5/29/18.

|

| DOT International Roadcheck

The DOT’s annual International Roadcheck dates are scheduled forJune 5-7th this year and is expected to target Hours of Service/ELDs.

This event is held annually to highlight safety in the transportation industry. To support safety in our industry, please make sure to pull to the outside lane should you see a truck pulled over on the side of the road.

|